StockBrokers com Honors: Finest Change Programs & Systems to have People

Before purchasing an excellent robo-coach, very first listed below are some all of our analysis of these two, Improvement versus Wealthfront. Whenever investing that have quick figures, feel is key in order to building wealth. If you’re able to regularly place a-flat amount of cash to the industry—actually $10 per week—you might be surprised at how fast it actually starts to develop. Which structure also helps so you can simple industry consequences, because you will be to find dips and you can peaks as the market goes up and you will down. Fidelity is certainly market chief in terms of minimizing costs, and its own clear and you may persuasive fee schedule is excatly why—to the fourth-year running—it gains to possess reduced will cost you.

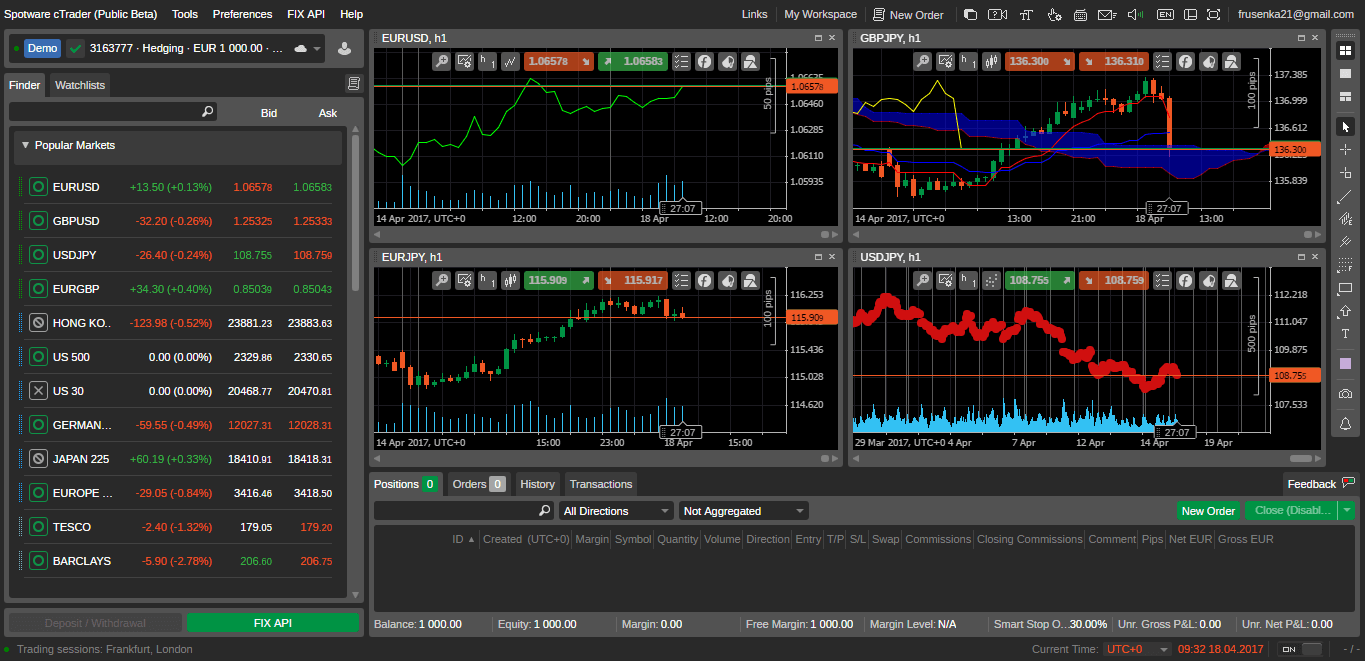

Thus, behave instantly to offer-moving news and you can bring far more business possibilities when smoother for you. You could exchange more than 10,000 United states Holds and you may citizenxtra.com ETFs, United states Equity Index possibilities, All of us Treasuries – and more – twenty-four hours a day. Entertaining Agents’ twin market stores make certain legitimate and you will reliable immediately exchange on your own routine.

Charles Schwab provides an extended pedigree of enabling private people, and therefore tradition remains completely intact. Schwab really does everything well, out of good trading systems and you will a standard assortment of tradable ties and you will features to help you responsive customer support at any time. EToro are a community-motivated program designed for buyers who require more than simply positions — they want dialogue.

What sort of on the web broker account do i need to prefer?

But not, these represent the critical indicators a trader may want to lookup away to own. Fidelity are designated since the a good all-rounder and its low-tiered platform commission could possibly get interest people with highest-worth profiles. Overall, eToro can interest convinced traders requiring limited help, or people attempting to trade in All of us, as opposed to Uk, offers. When you are Trade 212 people can access help through the software, keep in mind truth be told there’s zero phone helpline. But not, when we checked out the internet chat provider, i had a quick response, and you may a great level of suggestions, responding to your inquiries. Bear in mind that assets inside a good money apart from sterling are in contact with currency exchange risk.

Best for Risk Government

More distressing is the shortage of quality assurance to your membership closure otherwise currency withdrawing knowledge. I won’t feel safe providing Elizabeth Change a high rating since the an inventory exchange program. Charles Schwab is one of the most really-understood and you may biggest disregard brokerages global. Started more than 50 years ago, they quickly turned into known as the location for quick change and you may lower charges. Charles Schwab will bring consumers that have complete service, targeting affordable and benefits.

How do i import my membership from broker to a different?

Stock agents may include financial advisors and the features talked about in this post. Buyers, concurrently, generally work with creditors investing carries and other investment for them. TD Head charges a comparable fee to have trade U.S. offers since it does to have Canadian offers. With over $step three trillion within the assets, the newest Toronto Stock-exchange (TSX) ranks twelfth worldwide however, heavily concentrates on the cyclical groups including finance, times, and you may material. To possess a far more healthy profile, it’s crucial that you discover an agent that gives use of global areas and you may foreign exchange.

Examples include Improvement, that is strictly a good robo-mentor, and you can Fundrise, that’s a real house crowdfunding platform. As the a couple prominent merchandising investment broker organizations in the us, these are generally complete-provider stockbrokers. Opt for adding a few solution investments for the collection combine.

As well, Webull allows you to trade fractional shares, allowing you to buy brings and you can ETFs to possess as little as $5, therefore it is accessible to possess traders which have reduced spending plans. If you’re looking to own a component-steeped platform that doesn’t hurt you wallet, Webull will probably be worth a look. Certainly its standout provides ‘s the lack of alternatives deal fees — a rarity in the market, because so many brokers charges for each-package costs for options. This is going to make Webull a good option for possibilities investors looking to save on can cost you.

The business has aggressive fees, fantastic customer care, lookup devices, and you will multiple exchange programs first of all so you can benefits. When you are only easing for the investing, of numerous better brokerages offer 100 percent free stock-trade networks that will get you off and running with no-fee trading no membership minimums. Robinhood are a popular change application which is known for their convenience and you can no payment charges.

Along with their CFP designation, the guy in addition to earned the fresh marks out of AAMS – Accredited Advantage Government Specialist – and you will CRPC – Chartered Later years Considered Therapist. While you are a training monetary mentor, Jeff is entitled to help you Investopedia’s famous set of Greatest 100 advisers (as much as #6) many times and you will CNBC’s Digital Advisory Council. Jeff are a keen Iraqi combat experienced and served 9 decades within the the newest Army Federal Protect. Their work is on a regular basis searched within the Forbes, Organization Insider, Inc.com and Business person.

Actually, specific automated exchange systems will go one stage further because of the position sales to your investors’ account. Not just does this match buyers with no feel, however, individuals with virtually no time to evaluate the brand new areas. Express coping costs not simply connect to the purchase away from brings, however, other conventional assets including ETFs, common financing, and funding trusts. Throughout but a few infrequent cases, a selected trading platform in britain usually charge a condo dealing payment. Launched inside 1974, the new brokerage firm the most established in the brand new British trading world. In reality, the working platform try on the London Stock exchange having a good field valuation of approximately $step three billion.